The New American Food Code: What the 2025 IFIC Survey Reveals About Trust, Values, and the Shifting Politics of Food Production

- Nov 30, 2025

- 6 min read

A Twenty-Year Lens on How Americans Really Think About Food

Every year, the International Food Information Council’s (IFIC) Food & Health Survey peels back another layer of the complex, emotionally charged, economically constrained, and increasingly value-driven relationship Americans have with their food. But the 2025 edition is particularly revealing. Based on responses from 3,000 adults ages 18 to 80, weighted to reflect the U.S. population and fielded in March 2025, it captures a moment in which food production, not just food itself, has become central to public consciousness.

The United States is not a homogeneous food culture, and this year’s survey makes that abundantly clear. Age, income, education, community type, and race shape how Americans interpret everything from sustainability to biotechnology. The data reflects a country in which half the respondents live in suburban areas, the largest share is between 18 and 49, and income distribution spans the full spectrum, from those earning under $20,000 a year to high earners above $150,000. These demographic anchors don’t merely add color; they shape perceptions and, critically, purchasing power.

Across the board, the 2025 survey shows rising curiosity, entrenched frustrations, and widening gaps between what people think food should be and what they can afford, understand, or trust.

Sustainability Matters, But Its Meaning Has Changed

Sustainability has now spent nearly a decade hovering in the same space, important but not decisive for most Americans. In 2025, 59% of respondents say environmentally sustainable production is important when they buy food, an increase from 2021 but still far below the 2016 high of 73% when the question first appeared in the survey.

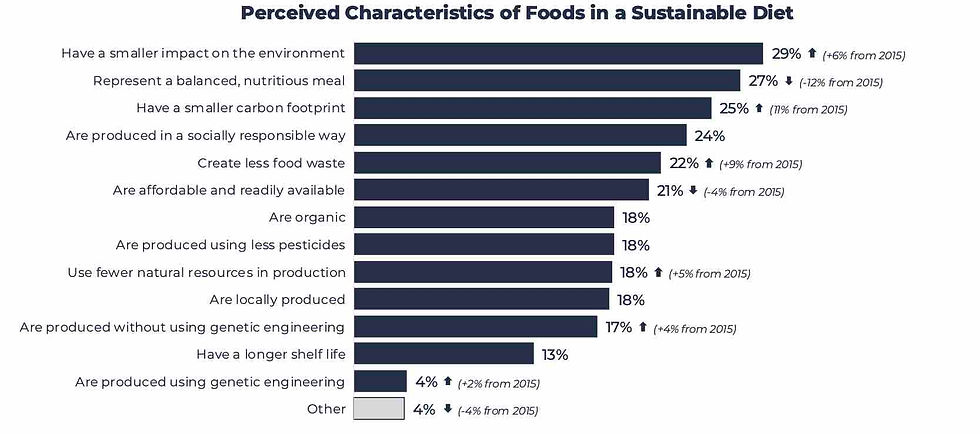

Yet what people mean by sustainability has shifted dramatically. Environmental attributes now dominate: smaller carbon footprints, reduced food waste, fewer natural resources used, and lower overall environmental impact, all saw meaningful increases compared to 2015. Nutrition, once central to the idea of sustainable diets, has declined as a defining factor. Affordability and availability, cornerstones of food access, also slipped.

These shifts suggest a cultural recalibration. Climate concerns now overshadow earlier nutrition-centric framing, even as Americans struggle to reconcile their environmental priorities with their real-world purchasing constraints. Sustainability as an aspiration is alive and well; sustainability as an actionable consumer behavior remains limited by price, convenience, and trust.

The Demand for Transparency Has Become Non-Negotiable

Among production-related values, one stands out above the rest: knowing where food comes from. In 2025, this was the most important attribute Americans looked for, chosen by 59% of respondents, an eight-point increase from 2017.

Origin has become a proxy for safety, ethics, and authenticity. It reflects a desire for stability in a system that often feels opaque and politicized. Younger consumers tend to express stronger interest in values-based cues; older consumers tend to focus more on safety and familiarity. But across demographic lines, origin resonates.

The rise of transparency also reflects disillusionment with the patchwork of labels populating supermarket shelves. Even though the label claims most frequently consulted are “natural” (41%) and “no hormones or steroids” (38%), these choices often communicate a desire for simplicity rather than scientific accuracy or environmental performance. Meanwhile, claims with clearer sustainability implications, recycled packaging, third-party certification, and sustainably sourced ingredients remain secondary.

The label hierarchy reveals a meaningful truth: consumers want to understand their food, but they gravitate toward what feels intuitive rather than what is technically meaningful. This gap is one of the food system’s most enduring communication failures.

Biotechnology: More Familiar, Less Trusted

Perhaps the sharpest trend in the report concerns biotechnology. As of 2025, nearly four in ten Americans view the use of biotechnology in food production unfavorably, a jump from 27% in 2016. What’s most notable is that this shift occurred even as unfamiliarity dropped. Only 15% of respondents say they don’t know enough to form an opinion, compared to 25% nine years earlier.

This isn’t a story about lack of exposure or education. It is a story about conviction. Americans feel better equipped to judge biotechnology, and many are judging it harshly.

The demographics deepen the story: younger consumers are slightly more open to biotech, older consumers remain markedly skeptical, and lower-income respondents tend to show stronger caution, likely tied to broader distrust of institutional decision-making and resource limitations. In this climate, any rollout of gene-edited crops, precision fermentation ingredients, or next-generation bioengineered foods will require unprecedented transparency and communication.

Taste Reigns, Price Pressures Intensify, and Healthfulness Splits Along Income Lines

Despite two decades of change, one truth remains immovable: taste dictates everything. Since 2006, it has outranked all other factors in Americans’ food decisions. In 2025, 84% of respondents say taste has a major impact on their choices, nearly unchanged from 20 years ago.

Price, though still second overall at 71%, tells a more volatile story. While perceptions of major price increases softened compared to 2023 and 2024, a staggering 86% of Americans still say food costs rose in the past year, with 62% perceiving the increase as “major”. Demographics again shape this reality. People in lower-income households consistently report price as a dominant factor; in households earning over $100,000, healthfulness actually surpasses price.

This split foreshadows widening nutritional inequalities. High-income households can afford to prioritize health. Lower-income households prioritize convenience, an adaptive response to time poverty, childcare responsibilities, and limited access to varied retailers.

Convenience surpassing healthfulness among households making under $35,000 a year is one of the most important signals in the report. It shows that food choice is not merely about values or knowledge; it’s about lived constraints.

Food Waste: A Critical Blind Spot

Food waste remains one of the least shifting attitudes in the entire survey. In 2025, 54% of Americans say they are concerned about the amount of food their household throws away, nearly identical to 2022. Despite rising prices, concern hasn’t intensified; despite climate awareness, urgency hasn’t grown.

This stagnation is striking. Food waste is low-hanging climate mitigation, a major household expense leak, and a key leverage point in emissions reduction. Yet it remains an emotionally distant issue for many households, perhaps because guilt, habit, and the invisibility of discarded food obscure its significance.

The lack of demographic movement here is also revealing. Unlike sustainability or biotechnology, both of which show variations by age and income, food waste attitudes appear stubbornly consistent across groups. Changing behavior in this domain will require not simply information but structural incentives and better household tools.

Labels: The Marketplace of Feelings, Not Facts

The label section of the report exposes one of the food system’s most persistent dynamics: consumers pay more attention to claims that feel meaningful than those grounded in rigorous standards. “Natural,” a marketing term without regulatory definition, eclipses “certified by a third-party environmental organization,” which only 10% of Americans consult. Packaging-related sustainability claims attract even less notice.

This is not a failure of consumers; it is a failure of communication. The proliferation of labels without clarity has created a marketplace of emotional cues rather than informational tools. Lower-income and lower-nutrition-literacy groups are especially vulnerable to misinformation here, widening the divide between perception and reality.

What the Core Demographics Reveal About the Future

In a report dense with numbers, the demographics act as connective tissue. They help explain why attitudes toward sustainability, biotechnology, and transparency vary so widely. Younger Americans tend to engage more with socially driven values; older Americans remain anchored to familiarity and safety. Households with higher education levels and higher incomes respond more strongly to healthfulness and environmental claims. Lower-income households consistently reflect financial and logistical constraints.

The survey, taken as a whole, shows that food values are not universal; they are contextual. They express not only ethics but also access, opportunity, and lived experience.

The Road Ahead: An American Food Landscape Defined by Contradiction and Opportunity

The 2025 IFIC Food & Health Survey captures a portrait of a nation at a pivotal moment. Americans express rising interest in where food comes from, growing concern about environmental impact, and increasing familiarity, though waning trust in food technologies. At the same time, they remain tethered to price pressures, polarized around science, and driven by taste above all else.

These tensions will shape the trajectory of food production, innovation, and communication in the coming decade. For industry leaders, retailers, policymakers, and innovators, the path forward requires more than new products. It demands transparency that resonates with lived realities; pricing strategies that make sustainable choices accessible; labeling that informs rather than confuses; and technology rollouts grounded in trust, not hype.

The American public is not disengaged. They are attentive, curious, and increasingly value-driven. But they are navigating a landscape where the information they want is not always the information they receive, and where the foods they wish to buy are not always the foods they can afford.

Comments